The role of technology in support of learning has morphed from what used to be a handful of authoring tools and a learning management system to complex, multi-layered technology stacks often referred to as learning ecosystems.

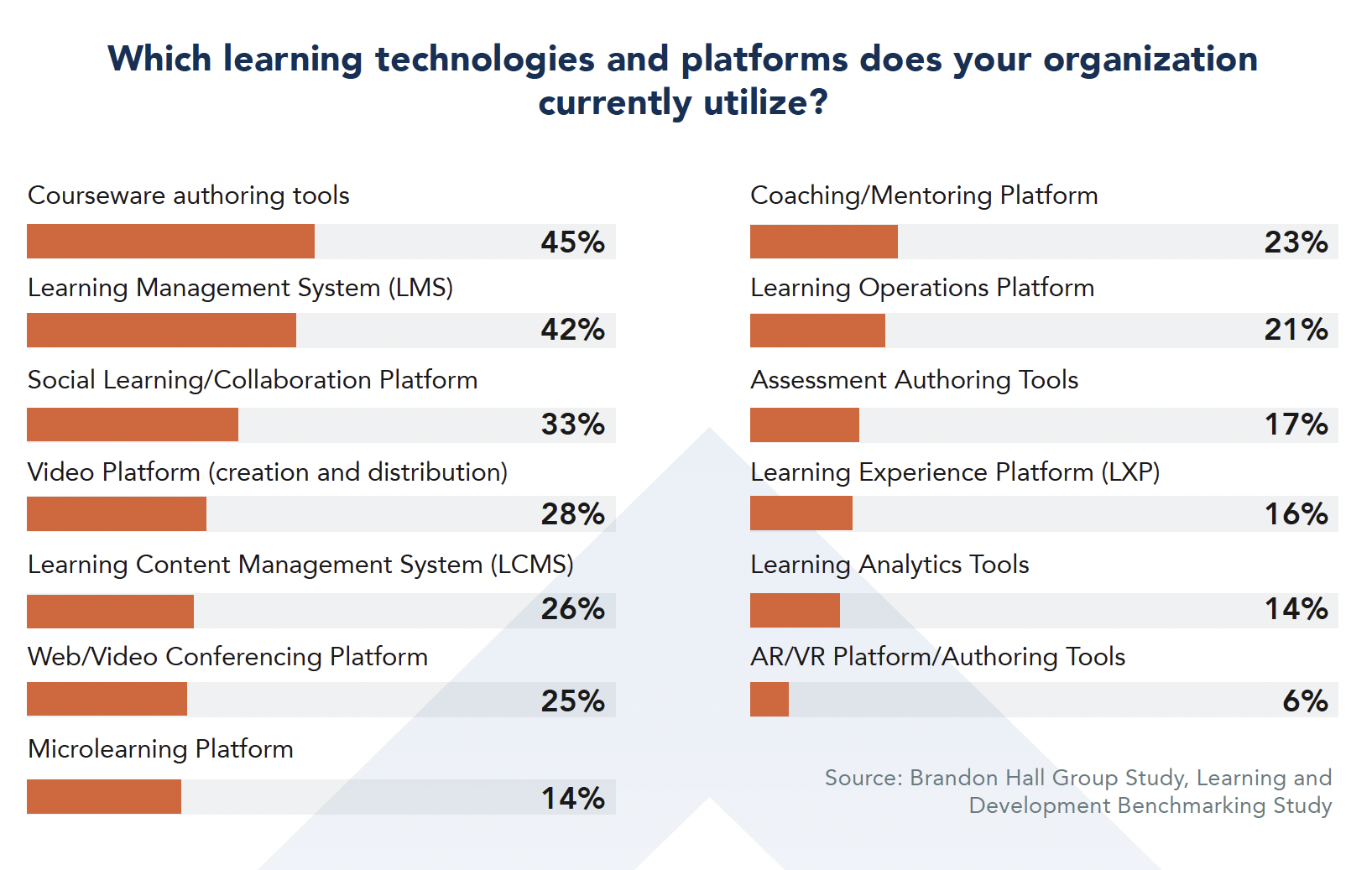

While authoring tools and Learning Management Systems are essential, they are no longer alone. Authoring tools (45 percent) and learning management systems (42 percent) still lead the pack, according to a Brandon Hall Group’s Learning and Development Benchmarking Study. Even many smaller companies now feature an LMS though the market appears far from saturated for mid-size businesses.

Social learning platforms have become mainstream ecosystem components, with 33 percent of respondents claiming to own one. Twenty-eight percent of respondents have a video platform, and 26 percent have a learning content management system. Not far behind are microlearning platforms at 24 percent. More than 20 percent own learning operations platforms and coaching/mentoring platforms. This indicates a solid growth trend and wide acceptance of all these technologies.

The fact that learning analytics tools are near the bottom in popularity at 14 percent may be one indicator of why Learning and Development (L&D) continues to struggle with learning measurement as a significant challenge. At 6 percent, augmented and virtual reality tools lag. Despite their promise, AR/VR are still fringe technologies and are more commonly found in large companies or enterprises.

Complexities

Across all business sizes, except large enterprises, respondents expect either an L&D budget increase (61.4 percent) or for the budget to stay the same (26.1 percent), a far more hopeful outlook than in our last benchmarking survey conducted in 2020.

When we asked respondents about the top challenges to their learning organizations, only 20 percent selected “Constraints with our technology.” However, when we looked closer at the data, we found enterprise-sized businesses (15,000 employees or more) found this to be a far more resonant challenge.

This is likely because larger businesses tend to feature more prominent, more complex learning technology stacks. The complexities of integrating learning technology stacks with more numerous business systems make for a more daunting challenge than one would experience in smaller organizations.

Consequences

Across all sizes of business, except large enterprises, respondents expect either an L&D budget increase (61.4 percent) or for the budget to stay the same (26.1 percent), a far more hopeful outlook than in our last benchmarking survey conducted in 2020.

Comparing benchmarking data from 2023 versus 2020, the technology allocation in L&D budgets has increased from 12.5 percent to a robust 30 percent. That’s good news for learning technology providers.

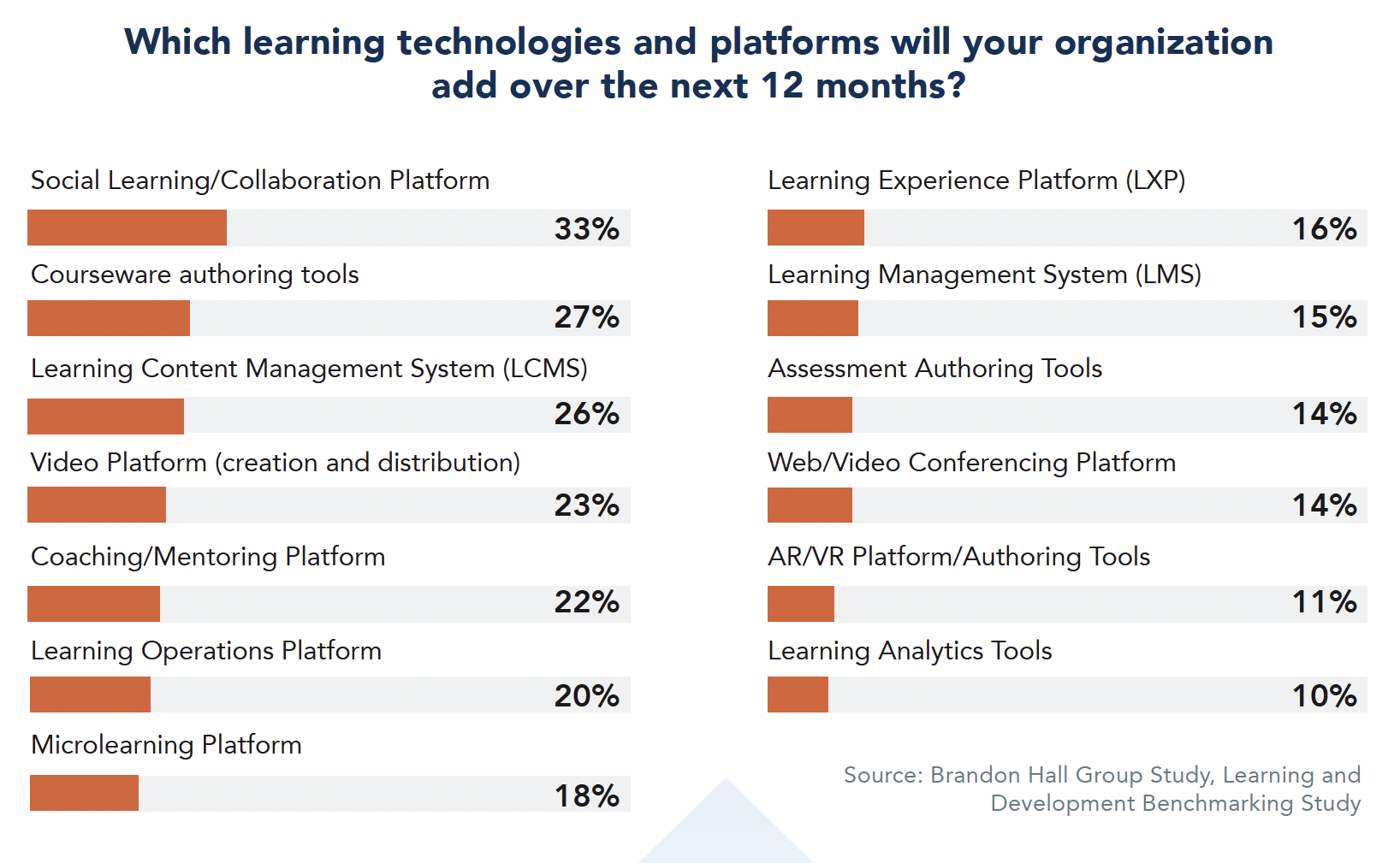

Where do learning organizations plan to spend their technology budget allocations? Social learning or collaboration platforms topped the list, with almost one-third indicating an intention to buy over the next year. Content creation is a critical driver for approximately one-fourth of respondents, who are looking for authoring tools (27 percent), LCMSs (26.1 percent), and video platforms (23.3 percent). Also in demand are coaching/mentoring platforms (22 percent) and learning operations platforms (20 percent).

AR/VR tools (11 percent) and learning analytics (10 percent) are the least desired technology purchases. AR/VR has yet to become a mainstream modality, and learning analytics platforms, despite learning measurement being the top challenge reported by our respondents, do not warrant much budgetary interest.

Critical Questions

- Do you have a strategy to explore, assess and select learning technologies that address costs, learning effectiveness, business case, and integration with your existing learning ecosystem?

- How effective is your current learning technology stack? Are there any critical gaps?

- Does your learning budget allocation percentage measure up against the reported average of 30 percent? If you ask for more, can you make a clear business case for the budget increase?

- Social learning functionality is a hot technology and is rated as instructionally effective. Is it missing from your learning technology stack?

Brandon Hall Group POV

For today’s L&D organization, navigating the learning technology space can be daunting. New learning technologies are constantly finding their way into the market. Technology vendors are rapidly merging, making acquisitions, and adapting and expanding their offerings to keep pace with their competitive peers.

It’s a steep challenge for an L&D organization to keep up, and an even steeper one to sift through this ever-evolving market and identify which learning technologies it makes sense to add given your organization’s needs, budget and existing technology stack.

It’s incumbent upon L&D organizations to invest the time and resources to learn about the learning technology space and keep abreast of its ever-evolving offerings and capabilities. While learning budget outlooks is rosier than in years past, it’s always easier to persuade executives and budgetary decision-makers with a business case that addresses organizational impacts, not just instructional effectiveness.

Certainly, technology vendors can provide some information to guide the creation of a business case based on their other clients, but it is up to the L&D team to paint the picture of what a new set of learning functionality can realistically achieve for their organization.